Is Cyber Liability Insurance Worth the Cost? Explore the Pros and Cons

By

Emily Miller

·

4 minute read

By

Emily Miller

·

4 minute read

With a steady barrage of cyber attacks threatening to bring down businesses every day, many organizations are turning to cyber insurance for a sense of security. According to a report by the research firm MarketsandMarkets, the cybersecurity insurance market is expected to grow from $11.9 billion in 2022 to $29.2 billion by 2027. This growth is driven by an increasing number of cyber attacks and data breaches, as well as the growing awareness of cyber insurance.

But what exactly does cyber insurance cover, and is it truly worth the investment? In this blog post, we'll delve into all the details of cyber liability insurance including what it covers, how much it costs, and whether or not it's the best way to protect your company from the ravages of an attack.

What is Cyber Liability Insurance?

Cyber liability insurance, also known as cyber insurance or cybersecurity insurance, is a type of coverage that protects businesses from financial loss due to a data breach, cyber attack, or other incident. These costs, which are incurred during event response and recovery, are typically divided into two categories, first-party and third-party.

First-party cyber liability insurance

First-party cyber insurance is coverage for the costs associated with responding to a data breach. These costs may include:

- Notification expenses

- Credit monitoring services

- Legal fees

- Data restoration

- Cyber extortion

Third-party cyber liability insurance

Third-party coverage is for liabilities incurred as a result of a cyber attack or data breach. These costs may include:

- Defense services against third-party claims or lawsuits

- Settling or paying damages to third parties

- Regulatory investigations or fines

Do You Need Cyber Liability Insurance?

When deciding whether or not to purchase cybersecurity insurance you should always assess and understand your risk profile. What type of data does your company store? Who has access to it? What other assets are connected to your systems?

If you handle sensitive customer data, such as financial information, Social Security numbers, or medical records, then you may want to put higher consideration on making a purchase.

When making this decision, we also recommend weighing some of the pros and cons.

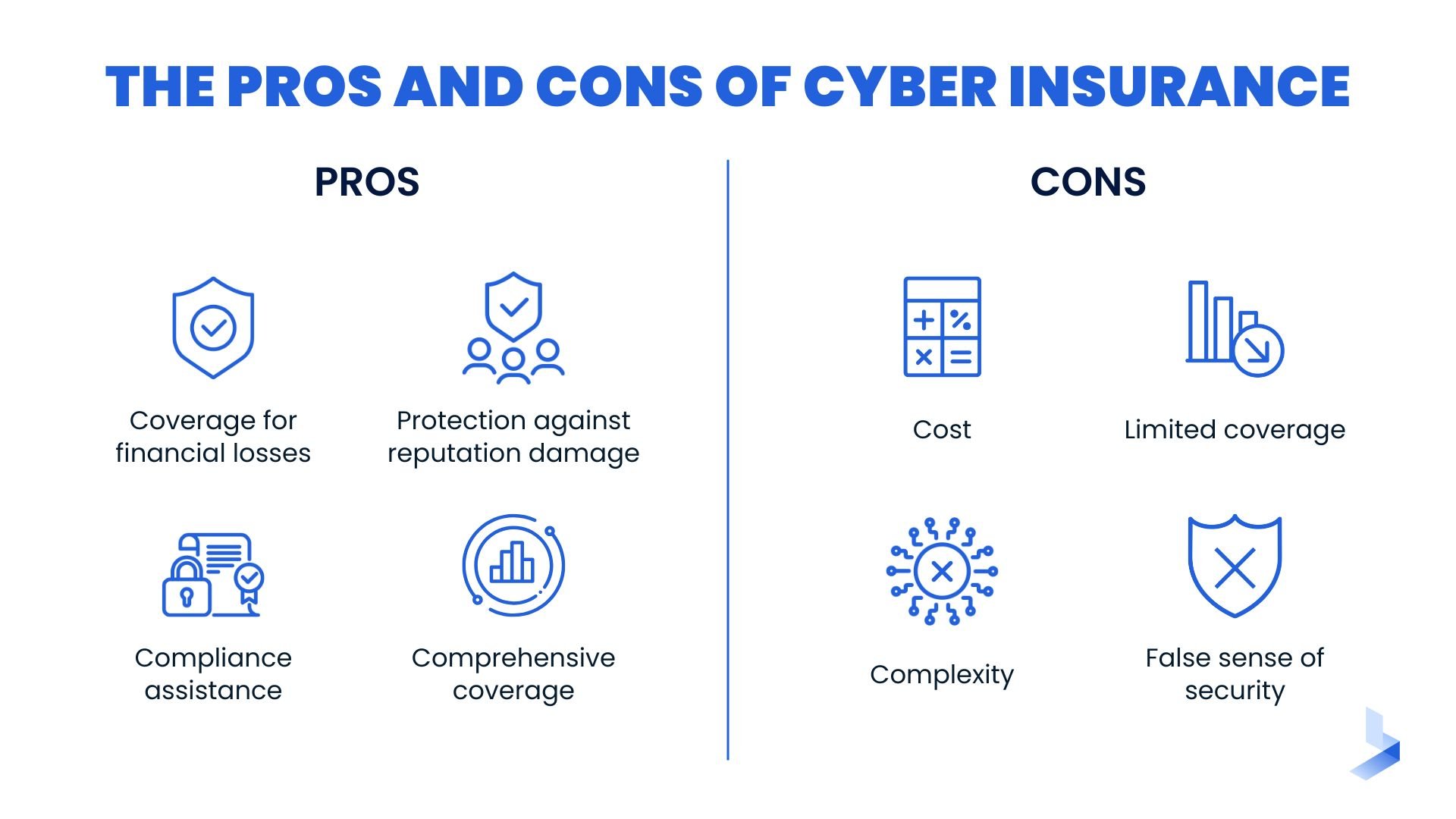

Pros and Cons of Cyber Insurance

As mentioned, cybersecurity insurance can be a valuable tool for businesses looking to protect themselves against the risks associated with cyber attacks and data breaches. However, like any insurance policy, it's important to carefully consider all the pros and cons before deciding whether it is the right choice for your business.

Pros

Cyber liability insurance can provide a number of benefits to businesses that are at risk of suffering from cyber attacks or data breaches. Some of the pros of this type of insurance include:

- Coverage for financial losses: Cyber liability insurance can help to cover the costs associated with responding to a cyber attack or data breach, including legal fees, public relations expenses, and any damages that are awarded as a result of a lawsuit.

- Protection against reputation damage: In the event of a cyber attack or data breach, a business's reputation can suffer significantly. Cyber liability insurance can help to protect against reputation damage by providing coverage for the costs of repairing or rebuilding a company's reputation.

- Compliance assistance: Many businesses are required to comply with various laws and regulations when it comes to data protection and privacy. Cyber insurance can provide assistance with compliance by covering the costs of assessments and audits, as well as any penalties or fines that may be imposed.

- Comprehensive coverage: Cyber liability insurance policies can provide coverage for a wide range of potential losses, including lost or stolen data, damage to computer systems, and business interruption caused by a cyber attack. This comprehensive coverage can help businesses to better protect themselves against the various risks they may face in the digital world.

Cons

While cyber liability insurance can provide important protections to businesses that are at risk of suffering from cyber attacks or data breaches, there are also some potential drawbacks to consider. Some of the cons of this type of insurance include:

- Cost: Cyber liability insurance can be expensive, especially for businesses that are considered to be at high risk for cyber attacks or data breaches. This can be a significant burden for small businesses or startups that may be operating on a tight budget.

- Limited coverage: Some cyber liability insurance policies may have exclusions or limits on the types of losses they will cover. For example, a policy may not cover losses resulting from employee negligence or failure to follow proper cybersecurity protocols.

- Complexity: Cyber liability insurance policies can be complex and may be difficult for businesses to understand. This can make it challenging for businesses to determine whether they are adequately covered or to identify any gaps in their coverage.

- False sense of security: Some businesses may feel that they are adequately protected with cyber liability insurance, which could lead to a false sense of security and a lack of vigilance when it comes to implementing strong cybersecurity measures. It's important to remember that insurance is not a replacement for good cybersecurity practices, but rather a tool to help businesses recover after an incident has occurred.

The Best Cybersecurity Insurance

While cyber liability insurance can provide some financial protection in the event of a cyber attack or data breach, it is still not a complete substitute for implementing adequate cybersecurity measures.

In addition to insurance, businesses should always consider partnering with a trusted IT partner to help ensure their cybersecurity measures are up-to-date. The best method to ensure good cybersecurity practices are being implemented is to utilize a Managed Detection and Response (MDR) service. A managed detection and response provider will deploy the necessary resources and technology needed to proactively detect and respond to any cyber threats that may arise.

By utilizing MDR, businesses can gain a better understanding of their exposure to cyber threats and take the necessary steps to protect themselves. Plus, having strong cybersecurity policies in place can actually help keep premiums down. Insurance providers often consider the security measures an organization has taken when determining the cost of a policy. This means that if you have invested in strong security measures, such as a robust firewall and frequent updates to your software, you may be eligible for lower premiums.

So if you do decide to purchase cyber insurance, make sure to also invest in good cybersecurity practices. That way, you can minimize your risk of suffering from a cyber attack and maximize the benefits of your policy.

If you need help establishing proper security protocol within your organization, reach out to one of our cybersecurity consultants to learn more about the power of MDR. They can help you create a comprehensive security plan to protect your business and data.